Retirement withdrawal calculator with inflation

The average inflation rate in the United States for. Your withdrawal will keep up with inflation.

Will You Have Enough To Retire The 4 Rule May Help Within Limits

Inflation is the general increase in prices and a fall in the purchasing power of money over time.

. Current Savings Annual Deposits Investment Return Inflation Annual Retirement Withdrawals Calculate. National Life Group is a. The 4 rule remains a safe.

In case of a. For 2021 the last full year available the CPI was 68 annually as reported by the US. For instance if you simulate between 1950 and 2000 with.

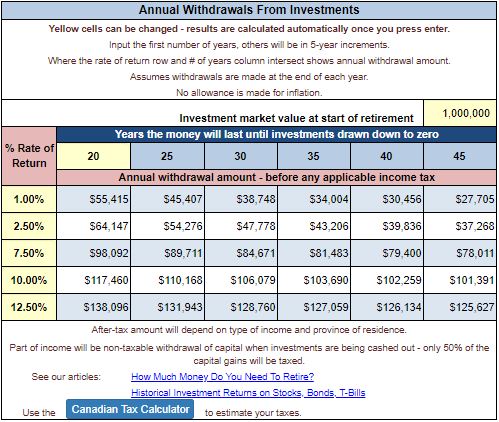

8 rows You decide to increase your annual withdrawal by 35 and want the money to last for 35 years. Bureau of Labor Statistics. The Nest Egg Withdrawal Calculator lets you determine how fast you will draw down the money in your nest egg by making withdrawals each year.

At the time of retirement this will provide a pre-tax income of which may increase at the rate of inflation. Im not planning to retire for 20 years so based on todays prices that 50000 is actually worth a lot less. With each successive year take out that same dollar amount plus an inflation adjustment.

This was created to be a basic retirement withdrawal calculator just to show individuals roughly how much they will be able to withdraw from their retirement accounts. During retirement withdraw 4 out of your savings the first year. Impact of Inflation on Retirement Savings.

The payouts during retirement will be adjusted for inflation the calculator uses the estimate of the inflation rate to calculate the. Over the last 40 years highest CPI recorded was 135 in 1980. Once again youll withdraw 5829357 the first year at 35 inflation equivalent to 4132541 today.

From 1925 through 2017 the CPI has a long-term average of 29 annually. Id use the PV formula to figure out the inflation-adjusted value. US Legal Forms library is your key to always having up-to-date legal documents specific to your state laws which you can save as.

Gross annual income during retirement G G F12. Use this calculator to analyze the impact of inflation on any future retirement needs you might have. For 2017 the last full year available the CPI was 20.

The initial withdrawal will be adjusted for inflation based on the number of years until your retirement. Your withdrawal is adjusted for inflation every month. Use this calculator to gain an understanding of how your savings can be affected by taxes and inflation.

The withdrawal is based on the withdrawal rate and the initial portfolio. With the calculator you specify whether you. Looking closer at the schedule.

Call us at 888-213-4695 or visit your. Various factors can have an impact on your savings over time. Retirement Withdrawal Calculator With Inflation.

- Enter an annual inflation rate to automatically increase the amount. Inflation adjustment formula INFLATION ADJUSTMENT Value1ADI100A Example of a calculation. Assumes you start saving per year increasing at the rate of inflation until you retire.

How does inflation impact my retirement income needs. Over the last 40 years the highest CPI recorded was 135 in 1980.

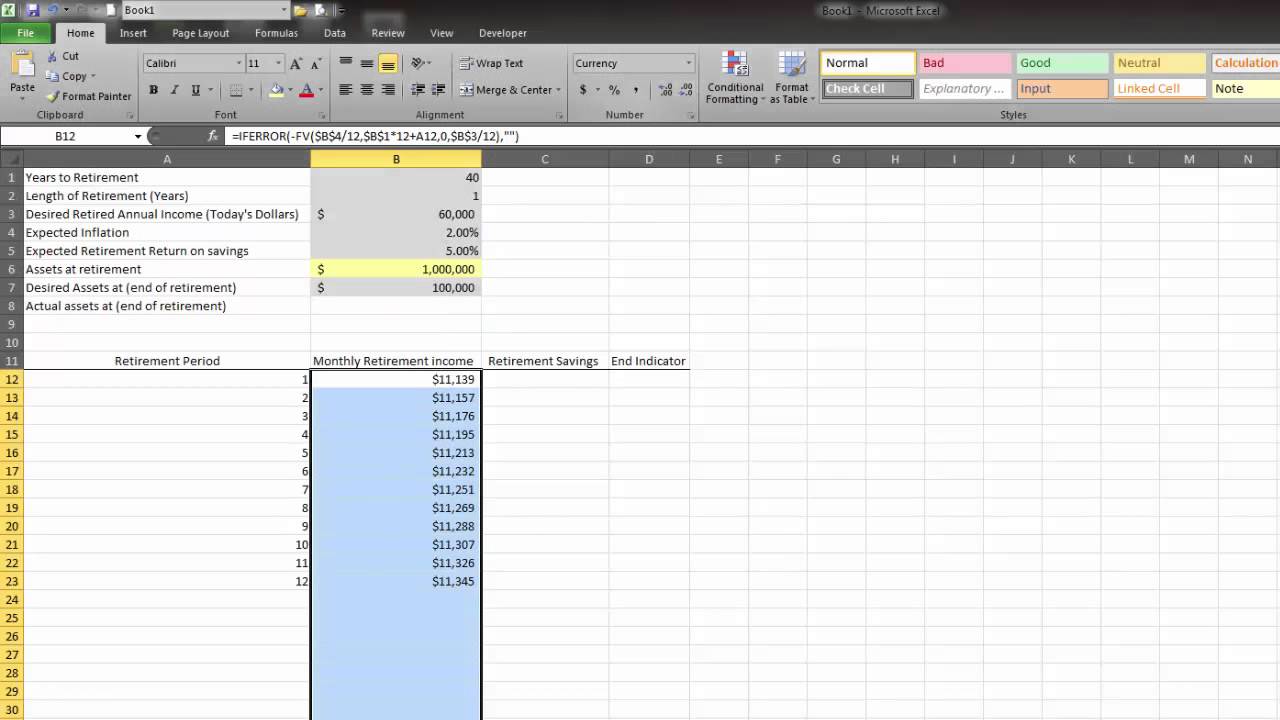

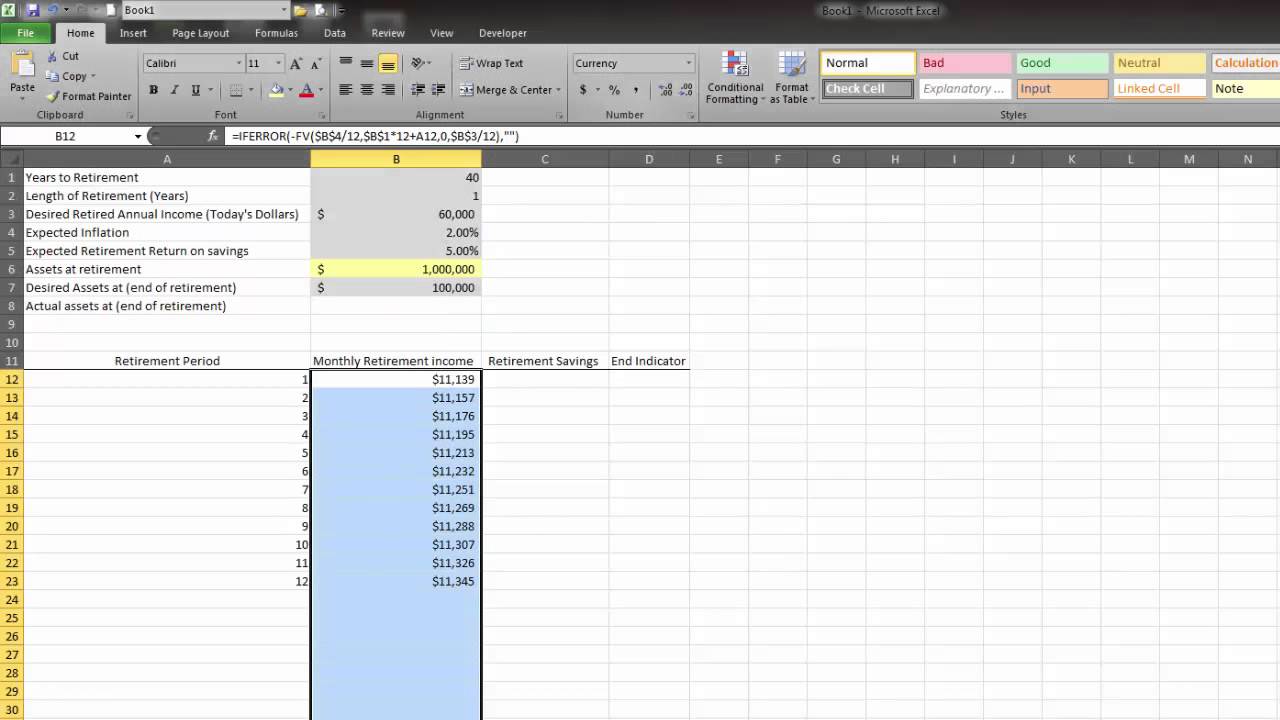

Workbook Fire Wealth And Retirement Calculator

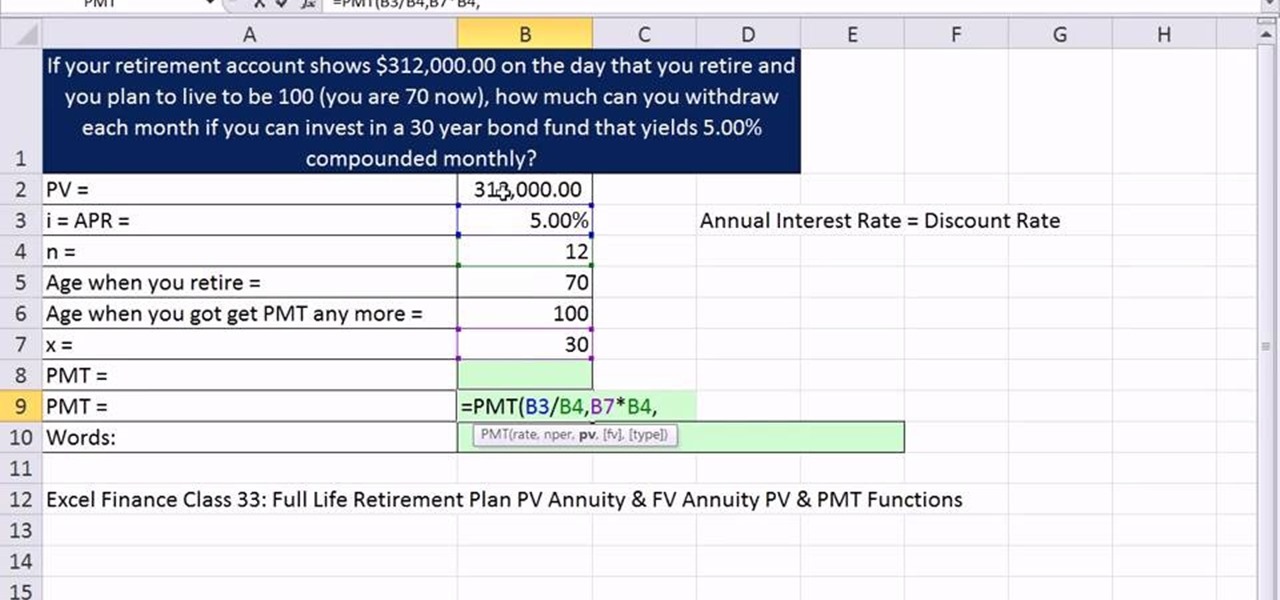

How To Calculate Monthly Retirement Income In Microsoft Excel Microsoft Office Wonderhowto

Retirement Age Calculator With Printable Schedule Chart

The 10 Best Retirement Calculators Newretirement

Retirement Withdrawal Calculator

Traditional Vs Roth Ira Calculator

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Canadian Retirement Calculator By Emily Glick

Finance With Excel Retirement Spending Calculator Youtube

Taxtips Ca Annual Retirement Income Calculator

Saving For Retirement Calculator Wealth Meta

Retirement Withdrawal Rate Calculator Financial Calculators Retirement Calculator Retirement Portfolio

Fire Calculator When Can I Retire Early Engaging Data

Firecalc Why Another Retirement Calculator

Retirement Withdrawal Calculator For Excel

Retirement Budget Calculator Do I Have Enough To Retire

Retirement Calculator